FBAR (Report of Foreign Bank and Financial Accounts) is the filing of foreign financial accounts, based on FATCA (Foreign Account Tax Compliance Act).

Filing can be done electronically through the FinCEN (Financial Crimes Enforcement Network) system.

You must file it if at any point of the previous year, you had foreign accounts that total at least $10,000 worth in US dollars.

The time limit of filing is June 30th.

Since I had over the threshold in 2014, I needed to file by June 30, 2015.

The exchange rate for Japanese Yen on December 31, 2014 was 119.4500.

Click on "Start Now" in the Online Form box.

Enter your best e-mail address, name, and phone number (no hyphens/dashes).

Enter a "Filing name".

This can be anything that's easy for you to remember.

Enter your information.

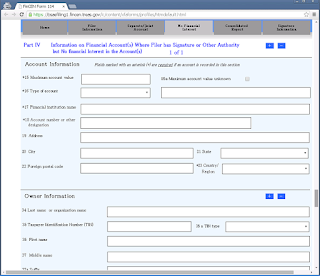

Enter the account information for each financial account you own.

Click the "+" button to add accounts.

Here too, don't put any hyphens/dashes in the postal code.

If you do not know some of the information, just put in as much as you know.

I don't have any joint accounts, but this is where you put the information in.

I don't have any "signature authority" accounts, either.

I don't have a "consolidated report", either.

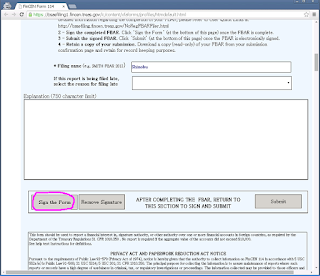

Once you are done, scroll back to the top to sign the form electronically.

Click on "Sign the Form".

"Sign"-ing is just clicking the "OK" button.

And it's considered signed.

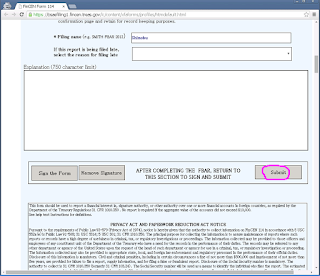

When all is done, go back to the the top of the form, and click "Submit" to file.

After it's submitted, the button goes away.

Don't forget to save the document, by clicking "Download copy of My FBAR".

You immediately get an e-mail of your submission.

After the file is accepted in their system, you receive another e-mail.

No comments:

Post a Comment