Please read the disclaimer first.

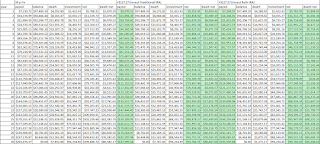

Let's say you have a 30 year fixed 4.5% loan for $100K.

Common wisdom says you should pay down the mortgage as fast as you can.

Or should you?

Of course, you get the warm fuzzy feeling of debt-freeness if you pay it down, but how about financially?

Let's first calculate how much you would pay in the life of the loan.

Your monthly payment is $506.69 x 360 =

$182,406.71

(The numbers are off a little because of rounding, but should be close enough. :))

So essentially, you pay about

82% more than your principal.

If you pay an

additional $127.27 a month toward the principal, you can pay off your mortgage in 20 years, for a total of

$151,642.41.

So you save about

$31K, or

16.9% of what you would have payed, and you're debt free for 10 additional years!

Sounds like a slam dunk, right? (If you have the extra cash, that is...)

Well, here are some points people will say against paying down your mortgage.

- You lose tax benefits.

- Inflation will lower your actual debt in the long run.

- If you die, PMI only cancels out the remaining balance.

- You can invest that additional money at a higher rate.

First, let's look at the tax benefits.

Let's say you're in the 15% tax bracket, and the comparison looks more like this.

So you're actually only paying

70% more on the 30 year fixed.

And the savings by paying down in 20 years is more like

15.4%.

But you still do save. :)

How about inflation?

Let's say there is going to be a 1% inflation, which means what you can buy today for a dollar, you need a dollar and a cent to buy it next year.

(I took off the tax deduction here, so we can compare just the effect of inflation.)

So you're actually only paying

58% of today's dollars more on the 30 year fixed.

And the savings by paying down in 20 years is more like

12.8%.

But you still do save. :)

How about PMI?

(PMI is basically a

life insurance plan that protects the lender from your death.)

Let's say you pay $25 a month on insurance to cover your balance.

So you're paying

91% more on the 30 year fixed, thanks to PMI.

And the savings by paying down in 20 years is

17.6%.

However, if you

die before the 25th year, you are going to be worse off than if you didn't pay extra.

(Of course, if you don't pay PMI, and cover with an individual insurance, this is not the case.)

How about investing?

I think 6% an year is a realistic conservative long term investment target.

If you invest the $127.27 instead of paying down your mortgage...

You will pay

25.1% more over 30 years, but net-net, you're

only paying 1.1% more than your loan amount.

(And

the standard disclaimer applies, investment percentages are not guaranteed, past performance is blah, blah, blah...)

So let's wrap up by combining everything.

First

if you pay PMI, paying down is risky

if you die before the 26th year.

If you

don't pay PMI, you start getting off

better from the third year.

And in both cases,

investing provides the best results.

Again, remember that

investment performance is not guaranteed.

By the way, if you invest in an IRA, things get even better. :)

It looks like the Roth is worse than the Traditional, but remember that you don't get taxed when you distribute from a Roth, so it's basically even.

One

final reminder... :)